We all know the real estate industry is hot right now and for many getting into the housing market, it can be a pipe dream. With tightening government and lending regulations, historically low interest rates and soaring housing prices, it can be a daunting endeavour for anyone.

Whether you are a first time home buyer, wanting to upsize to accommodate your growing family or purchasing an investment property, these are the factors that lenders will be looking at. This will determine which mortgage type and interest rate will be available to you.

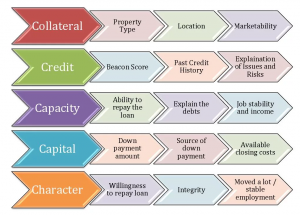

Know Your 5 C’s:

Collateral – The property itself that you are hoping to purchase.

Capital – Where is your down payment coming from? At a minimum, you need 5% down for a “high ratio” insured mortgage or a “conventional” mortgage with 20% down. This money can come from your own resources or can be gifted from a family member. Requirements will vary, so make sure to check with your mortgage professional.

Credit – Do you have proven credit and show a good history of repayment?

Capacity – The most important by far! How are you going to pay for your mortgage? Proof of income and requirements differ depending on whether you are salaried, self- employed, paid hourly or somewhere in between!

Character – Are you a super person? This is the least important factor to lenders these days.

Just as important to consider, when deciding on your mortgage, is to determine your current financial situation and longer term goals. This will help you decide which mortgage term and amortization (for example a 5 year term with a 25 year amortization) and mortgage rate (variable or fixed) is best for you. Finally, don’t forget to discuss the FEATURES that come with your mortgage as this could save you thousands of dollars and potential grief over the term of the mortgage. These features can include pre-payment options, lower early payout penalties and portability, providing you with flexibility and options for paying down your mortgage faster or making changes, should the need arise.

Mortgages are NOT a one size fits all, so always make sure to contact and discuss your options with a licensed mortgage professional BEFORE preparing to find the home of your dreams.

Contact me for your best mortgage options 705.669.7798 or trina@ndlc.ca

#trinamortgages #mortgages #ndlc #freedomofchoice

#bestmortgageforme #executive #firstimehomebuyer

If you found this information valuable, I only ask that you share with your friends and family.

Copyright DLC